Explore mini split systems, discover tax credits, and learn the benefits and application process to maximize your savings with installation.Are you considering upgrading your home’s heating and cooling system? If so, installing a mini split system could be the perfect solution not only for enhanced comfort but also for potential financial benefits. With rising energy costs and an increasing emphasis on energy efficiency, many homeowners are looking for cost-effective alternatives to traditional HVAC systems. What’s more, you might be eligible for tax credits that make this upgrade even more affordable. In this blog post, we will delve into the ins and outs of mini split systems, guide you on how to qualify for available tax credits, and discuss the myriad benefits of installation. We’ll also walk you through the application process so you can maximize these savings. Let’s explore the advantages of mini splits and how you can take advantage of the incentives available to make your home more efficient and budget-friendly.

Understanding Mini Split Systems

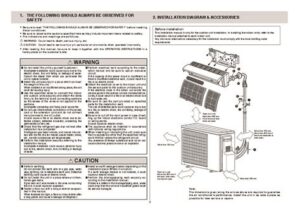

A mini split system is a type of heating and cooling system that offers flexibility, efficiency, and performance. Unlike traditional centralized systems that require ductwork, mini split systems consist of an outdoor compressor unit and one or more indoor air-handling units. This makes them ideal for homes that lack ductwork or for specific rooms needing climate control.

One of the key advantages of mini split systems is their energy efficiency. They use inverter technology to adjust the compressor speed as needed, reducing energy consumption while providing consistent comfort. Additionally, these systems often come with features like programmable settings and zoning capabilities, allowing users to control the temperature of individual rooms independently.

Furthermore, the installation process for mini split systems is generally less invasive than that of traditional systems. The indoor units are mounted on walls and connected to the outdoor unit via small refrigerant lines and drainage pipes. This compact installation method can result in lower labor costs and quicker installation times, making it a popular choice among homeowners looking to upgrade their HVAC systems.

Qualifying for Tax Credits

When it comes to installing mini split systems, one of the significant advantages is the potential for receiving tax credits. To take full advantage of these financial benefits, it is essential to understand the qualifying criteria.

In order to qualify for the tax credits, homeowners must ensure that their mini split systems meet specific energy efficiency standards set by the government. These standards often include requirements on the heating seasonal performance factor (HSPF) and the seasonal energy efficiency ratio (SEER). To get the maximum benefits, it is advisable to choose energy-efficient models that align with these criteria.

In addition to the system’s specifications, eligibility may also depend on other factors, including the type of residence and whether installation is completed by a qualified professional. Be sure to check the latest guidelines, as tax credit prog

Benefits of Mini Split Installation

Installing a mini split system in your home or office offers a variety of benefits that can enhance comfort, efficiency, and overall air quality. One of the primary advantages is the improved energy efficiency compared to traditional HVAC systems. Mini splits utilize advanced inverter technology, which enables them to adjust their power output according to the current temperature needs, thus saving on energy costs.

Another significant benefit of mini split installations is their flexibility in terms of placement. These systems consist of an outdoor compressor unit and one or more indoor air handlers, which can be strategically placed in different rooms. This zoning capability allows for optimal temperature control in individual spaces, making it possible to customize heating and cooling preferences for every area.

In addition to comfort and efficiency, mini split systems help improve indoor air quality. Many models come equipped with advanced filtration systems that can filter out dust, allergens, and other airborne particles, leading to a healthier living environment. Moreover, since mini splits do not rely on ductwork, they avoid the common issues of duct leakage and dust accumulation often associated with traditional heating and cooling systems.

Tax Credit Application Process

If you’ve installed a mini split system, you might be eligible for various tax credits that can significantly reduce the overall cost. However, understanding the tax credit application process is crucial to ensure that you maximize your benefits.

The first step in applying for a tax credit is to gather all necessary documentation. This includes:

- A copy of your purchase receipt or invoice for the mini split system

- Documentation proving the installation date

- Any manufacturer certification that meets energy efficiency standards

Next, you’ll need to complete the appropriate tax forms. For energy efficiency upgrades, you typically fill out IRS Form 5695. Be sure to accurately report the amount spent on your mini split installation to claim the tax credit. Once your forms are filled out, submit them along with your tax return.

Finally, it’s recommended to keep copies of all submitted documents and forms for your records. Additionally, consult with a tax professional if you’re uncertain about any step in the application process to ensure you

Maximizing Tax Credits for Mini Split

When it comes to installing a mini split system, many homeowners overlook the potential financial benefits that can come from tax credits. Understanding how to maximize these credits can significantly reduce the overall cost of your mini split installation. In this section, we will explore a variety of strategies to ensure you take full advantage of available credits.

First and foremost, it is crucial to stay informed about the current tax credit programs available for energy-efficient home upgrades. Many of these programs are offered at the federal level and may vary by state, so it’s essential to consult the IRS website or your local tax authority for the most accurate and up-to-date information. An easy way to keep track of these offerings is to subscribe to newsletters or follow relevant organizations that focus on energy efficiency and tax benefits.

Next, consider the specifications and efficiency ratings of the mini split system you plan to install. Different models may qualify for varied levels of tax credits based on their energy efficiency. Aim for systems that meet or exceed the Energy Star® ratings, as these are often eligible for increased tax deductions. Additionally, obtaining all necessary documentation from your installer will help you substantiate your claim during tax season.

Finally, organizing and preparing your tax credit application in advance can streamline the process. Make sure to keep all receipts, product manuals, and any correspondence related to your installation and maintenance. This documentation will not only support your application but will also be invaluable if you’re ever audited. By following these strategies, you can maximize your earnings and savings related to the mini split installation.

Frequently Asked Questions

What is a tax credit for installing a mini split system?

A tax credit for installing a mini split system is a financial incentive provided by the government to homeowners who install energy-efficient heating and cooling systems in their homes. This credit reduces the amount of tax owed, encouraging the use of energy-saving technologies.

Who is eligible for the tax credit for mini split installation?

Eligibility for the tax credit typically includes homeowners who install qualifying mini split systems in their primary residence. Specific eligibility criteria may vary by state and federal guidelines, so it’s important to check current regulations.

How much can one save with the tax credit for installing a mini split?

The savings from the tax credit can vary, but homeowners could potentially receive a percentage of the installation costs back as a credit on their tax return, which can range from a few hundred to over a thousand dollars depending on the system and applicable credits.

What types of mini split systems qualify for the tax credit?

To qualify for the tax credit, mini split systems typically need to meet certain energy efficiency standards, such as SEER (Seasonal Energy Efficiency Ratio) ratings. It’s important to consult the current tax guidelines to ensure that the system being installed meets the necessary criteria.

Do I need to file any specific forms to claim the tax credit for mini split installation?

Yes, homeowners usually need to fill out specific tax forms to claim the tax credit, such as IRS Form 5695, which is used to calculate residential energy credits. Make sure to keep all installation receipts and product specifications for filing.

Can I still receive the tax credit if I use financing to pay for the mini split installation?

Yes, homeowners can still claim the tax credit even if they finance the installation of a mini split system. The credit is often based on the total installation cost, regardless of how the homeowner chooses to pay for it.

Is there a deadline to claim the tax credit for installing a mini split?

Deadlines to claim the tax credit may depend on the tax year the installation was completed. It’s advisable to check the IRS guidelines or consult a tax professional to ensure the credits are claimed correctly within the necessary timeframe.